2023 Form 1040-SR: Crucial Details to Consider

As the tax season fast approaches, the 2023 1040-SR form may come up for those aged 65 and older. This IRS rendition, generated specifically to cater to the tax requirements of senior American citizens, provides a comprehensive rundown of the tax implications in relation to retirement distributions, social security benefits, and investment outcomes.

Tax Form 1040-SR in 2023: Basic Rules

Let me furnish some circumstances wherein one might need to familiarize themselves with this form:

- If you begin receiving civil service retirement benefits, you may need to complete the 1040-SR 2023 tax form.

- If your employer were to institute a defined benefit pension plan and you choose to use these distributions in 2023, you'd potentially use this form too.

In such cases, you would isolate the parts of your retirement distributions that aren't subjected to tax. Consider professional taxation advice to breeze through faultlessly.

The IRS Form 1040-SR Submission Without Errors

Dissimilar to regular tax returns, the IRS Form 1040-SR instructions for 2023 provide itemized remedies for errors. You might need to obtain an authentic Form 1040X and use it to produce an amended tax return, including any modified schedules or forms, and then mail it all to the IRS.

When amending a previous return that included Form 8857, filing for innocent spouse relief, maintain a copy of the return. It’s wise—notwithstanding your filing status—considering both originally-filed married jointly and separately, Form 1040s are integral in deciphering a new relief claim. A tax accountant can guide maneuvering this seemingly complicated path.

Tax Form 1040-SR: Frequently Asked Questions

Understanding fills anxiety with foresight. Here are some standard questions people often have about IRS Form 1040SR:

- Can I file Form 1040-SR if I'm under 65?

Just like Form 1040, you can utilize the 1040-SR if you or your spouse is at least 65 by the end of the year. - Can I use tax form 1040SR in 2023 if I'm married and filing jointly and only one of us is over 65?

Yes, you can, just as long as one spouse is 65 or older. - Can I file Form 1040-SR online like a regular 1040?

Indeed. The form is readily obtainable online, and services are available for electronic tax resolution.

The dynamics of the impending tax season may change. However, leaning on the fundamentals of anyone's tax obligations leads to prudent tax decisions. Maintaining a sharp knowledge of advent tax-related norms, in this case, adapting to the introduction of IRS Form 1040-SR in 2023, can take a long mile in your financial journey.

Related Forms

-

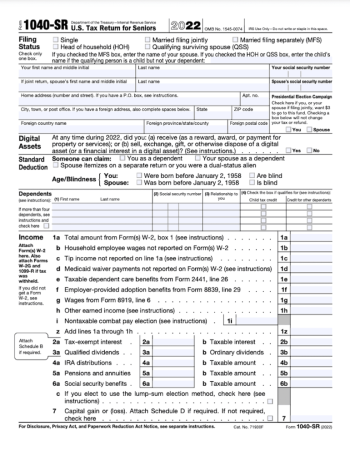

![image]() 1040-SR To clearly understand your taxation needs as an American citizen, it is crucial to familiarize yourself with all necessary documents, such as the IRS Form 1040-SR. This specific form is primarily designed for those who are 65 and older to simplify the process of filing a federal income tax return. It provides comprehensive details about your sources of income, fiscal deductions, credits, and the ultimate tax or refund amount. The straightforward and self-explanatory design of fillable IRS Form 1... Fill Now

1040-SR To clearly understand your taxation needs as an American citizen, it is crucial to familiarize yourself with all necessary documents, such as the IRS Form 1040-SR. This specific form is primarily designed for those who are 65 and older to simplify the process of filing a federal income tax return. It provides comprehensive details about your sources of income, fiscal deductions, credits, and the ultimate tax or refund amount. The straightforward and self-explanatory design of fillable IRS Form 1... Fill Now -

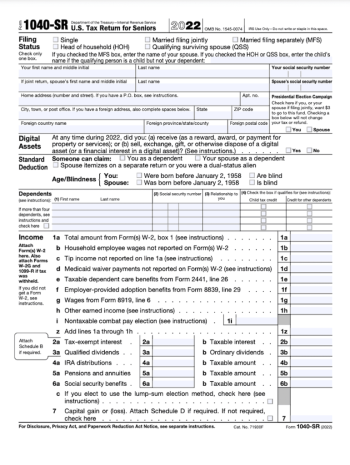

![image]() IRS Form 1040SR for 2023 This article seeks to extend detailed information and guidance for the IRS Form 1040SR for 2023 (U.S. Tax Return for Seniors). Having historical roots extending back to 2018, Form 1040-SR became a consequence of the Bipartisan Budget Act, which sought to establish a simplified tax form for seniors. It is specifically designed to aid taxpayers who are 65 or older with a more streamlined way of filing their taxes. Possessing a larger font than the traditional tax forms and including a special chart for determining the standard deduction, the 1040SR printable form enhances the ease of the tax completion process for our deserving seniors. Form 1040SR: Significant Alterations Changes to tax forms are an annual occurrence that often results in significant shifts in how individuals and businesses complete their taxes. The previous year has ushered in crucial alterations to tax form 1040SR for 2023. However, these are not drastic deviations but rather crucial tweaks designed to enhance comprehensibility and increase user-friendliness. While the substantial character of the 1040SR form remains unaltered, taxpayers will note updated income brackets adjusted annually for inflation. Who Qualifies for Form 1040SR in 2024 By understanding who can utilize the document, we recommend checking the IRS 2023 Form 1040SR instructions, so individuals can ensure they are maximizing their potential tax benefits. The key qualifier for this specific form is age. As of the end of the tax year, if you find yourself to be 65 or over, this form may apply to you. This extends to couples, too - if one partner is 65 or older, the couple can jointly file with this particular form. Possessing no restriction on the forms of income that can be reported, this form can handle any variety of income, from traditional employment through investment income and social security benefits. IRS Form 1040SR: Key Takeaways Having reached the nitty-gritty of these instructions, being able to print the 1040SR form from our website and take full advantage of its simplicity requires understanding important details like exemptions and deductions and applying the tax rules for required income. It's essential to check against the chart provided for standard deductions and updates, which are determined annually. At the end of the day, we learn that every cent matters when it comes to your retirement income, including tax deductions. Taking advantage of tools such as the IRS Form 1040SR thus becomes integral to navigating the complexities of taxes in our golden years. Fill Now

IRS Form 1040SR for 2023 This article seeks to extend detailed information and guidance for the IRS Form 1040SR for 2023 (U.S. Tax Return for Seniors). Having historical roots extending back to 2018, Form 1040-SR became a consequence of the Bipartisan Budget Act, which sought to establish a simplified tax form for seniors. It is specifically designed to aid taxpayers who are 65 or older with a more streamlined way of filing their taxes. Possessing a larger font than the traditional tax forms and including a special chart for determining the standard deduction, the 1040SR printable form enhances the ease of the tax completion process for our deserving seniors. Form 1040SR: Significant Alterations Changes to tax forms are an annual occurrence that often results in significant shifts in how individuals and businesses complete their taxes. The previous year has ushered in crucial alterations to tax form 1040SR for 2023. However, these are not drastic deviations but rather crucial tweaks designed to enhance comprehensibility and increase user-friendliness. While the substantial character of the 1040SR form remains unaltered, taxpayers will note updated income brackets adjusted annually for inflation. Who Qualifies for Form 1040SR in 2024 By understanding who can utilize the document, we recommend checking the IRS 2023 Form 1040SR instructions, so individuals can ensure they are maximizing their potential tax benefits. The key qualifier for this specific form is age. As of the end of the tax year, if you find yourself to be 65 or over, this form may apply to you. This extends to couples, too - if one partner is 65 or older, the couple can jointly file with this particular form. Possessing no restriction on the forms of income that can be reported, this form can handle any variety of income, from traditional employment through investment income and social security benefits. IRS Form 1040SR: Key Takeaways Having reached the nitty-gritty of these instructions, being able to print the 1040SR form from our website and take full advantage of its simplicity requires understanding important details like exemptions and deductions and applying the tax rules for required income. It's essential to check against the chart provided for standard deductions and updates, which are determined annually. At the end of the day, we learn that every cent matters when it comes to your retirement income, including tax deductions. Taking advantage of tools such as the IRS Form 1040SR thus becomes integral to navigating the complexities of taxes in our golden years. Fill Now -

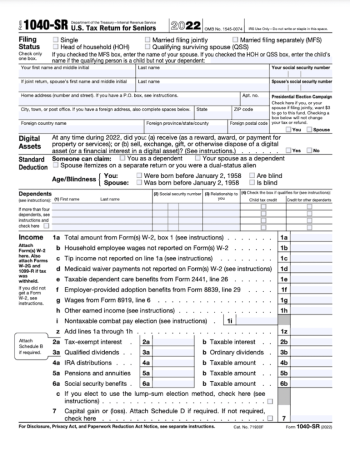

![image]() Printable New 1040-SR Tax Form In your journey towards being financially informed, it is crucial to understand the layout of vital tax documents. One document that demands attention is the IRS Form 1040-SR printable designed for retired people in the USA. This document is primarily crafted for senior taxpayers above the age of 65 and comprises five essential segments: Filing Status, Income and Adjusted Gross Income, Tax and Credits, Other Taxes, and Payments. Therefore, being familiar with these sections can expedite the process of form completion and foster proper fiscal management. Guidelines for Printable 1040-SR Form Filling While the IRS provides a free printable 1040-SR form, correctly completing it can occasionally pose a slight challenge. However, these simple instructions can help: Complete Personal InformationFill out the general information section accurately, including your social security number (SSN), name, address, and standard deductions. Input IncomeProperly document multiple types of income, such as wages, Social Security benefits, and pension & annuity earnings, corresponding to the given lines. Calculate TaxUse tax tables or the Qualified Dividends and Capital Gain Tax Worksheet (enclosed) to determine total tax. Consider CreditsNote any applicable tax credits which may reduce your fiscal liability. Payment CalculationIn case you've made any estimated payments or had tax withheld, make sure to account for these while filling out this section. Process of Federal Form 1040-SR Submission The process of submission for a printable new 1040-SR tax form is straightforward. Once completed, the form must be mailed to the Internal Revenue Service (IRS) at their specified address for your given state. If you anticipate a tax refund, consider linking a bank account to receive the refund via direct deposit. This involves noting your bank's nine-digit routing and account numbers in the Refund section of Form 1040-SR. On the other hand, if tax payment is due, you can attach a check made out to the "-United States Treasury-" with your form. Watch Out for the Deadline The deadline for submitting your tax form 1040-SR printable is usually April 15th, following the fiscal year. It is imperative to file the form by this deadline to avoid potential penalties from the IRS. However, if you need additional time, you can request an extension, which grants you until October 15th to file. In summary, a good grasp of how to fill and submit the printable IRS tax form 1040-SR will significantly ease your annual return filing process. With this guide, you should feel more confident in this undertaking. Fill Now

Printable New 1040-SR Tax Form In your journey towards being financially informed, it is crucial to understand the layout of vital tax documents. One document that demands attention is the IRS Form 1040-SR printable designed for retired people in the USA. This document is primarily crafted for senior taxpayers above the age of 65 and comprises five essential segments: Filing Status, Income and Adjusted Gross Income, Tax and Credits, Other Taxes, and Payments. Therefore, being familiar with these sections can expedite the process of form completion and foster proper fiscal management. Guidelines for Printable 1040-SR Form Filling While the IRS provides a free printable 1040-SR form, correctly completing it can occasionally pose a slight challenge. However, these simple instructions can help: Complete Personal InformationFill out the general information section accurately, including your social security number (SSN), name, address, and standard deductions. Input IncomeProperly document multiple types of income, such as wages, Social Security benefits, and pension & annuity earnings, corresponding to the given lines. Calculate TaxUse tax tables or the Qualified Dividends and Capital Gain Tax Worksheet (enclosed) to determine total tax. Consider CreditsNote any applicable tax credits which may reduce your fiscal liability. Payment CalculationIn case you've made any estimated payments or had tax withheld, make sure to account for these while filling out this section. Process of Federal Form 1040-SR Submission The process of submission for a printable new 1040-SR tax form is straightforward. Once completed, the form must be mailed to the Internal Revenue Service (IRS) at their specified address for your given state. If you anticipate a tax refund, consider linking a bank account to receive the refund via direct deposit. This involves noting your bank's nine-digit routing and account numbers in the Refund section of Form 1040-SR. On the other hand, if tax payment is due, you can attach a check made out to the "-United States Treasury-" with your form. Watch Out for the Deadline The deadline for submitting your tax form 1040-SR printable is usually April 15th, following the fiscal year. It is imperative to file the form by this deadline to avoid potential penalties from the IRS. However, if you need additional time, you can request an extension, which grants you until October 15th to file. In summary, a good grasp of how to fill and submit the printable IRS tax form 1040-SR will significantly ease your annual return filing process. With this guide, you should feel more confident in this undertaking. Fill Now -

![image]() Tax Form 1040-SR Instructions IRS tax form 1040SR instructions are designed to assist taxpayers, particularly those who are 65 or older, through filing their annual returns. The form, initiated by the Internal Revenue Service (IRS), was designed to simplify the tax filing process and reduce the chances of errors. By understanding how to use this document correctly, senior citizens can more effectively navigate the relatively complex US taxation system. The Purpose of IRS Form 1040-SR A question frequently asked is the specific purpose of instructions for IRS Form 1040-SR and who it is intended for. This tax form is designated for seniors aged 65 and older who may preferentially use this sample over the standard Form 1040. While not obligatory, the use of Form 1040-SR can be beneficial due to its large, easy-to-read print, and its layout emphasizes income streams relevant to seniors, including Social Security income, retirement plan distributions, and investment income. Using 1040-SR Tax Form: Keys to Consider The form may not be overly complex once you understand the distinct components and the relevant income sources. Here's a summary of key aspects you need to consider: The use of the 1040-SR tax form instructions to accurately report income from various sources that are common among seniors, such as pensions, annuities, and social security benefits, among others. The form features a standard deduction chart which is convenient for taxpayers who opt not to itemize deductions. Following the instructions can help you to determine your standard deduction and taxable income smoothly. Mind the stipulated age criterion. The IRS only permits the utilization of Form 1040-SR for taxpayers who are 65 years or older by the close of the tax year for which they are filing. Common Mistakes in Filling the 1040-SR Form The tax form 1040-SR instructions are meant to guide you through the process, but common mistakes can still occur. These might include errors in: income reporting, misspecifying filing status, incorrect calculations of the standard deduction. To avoid such errors, seek guidance from IRS documentation, hire a professional tax adviser, or use reliable software designed for this purpose. Such resources can inform you of any IRS changes for 2023 and beyond. Remain vigilant while filing, and understand the process becomes less complex with time, preventing future complications and ensuring a smoother tax return process. Do remember to factor in tax updates and amendments, such as those in IRS Form 1040-SR instructions for 2023, as these changes might substantially impact your tax position. Fill Now

Tax Form 1040-SR Instructions IRS tax form 1040SR instructions are designed to assist taxpayers, particularly those who are 65 or older, through filing their annual returns. The form, initiated by the Internal Revenue Service (IRS), was designed to simplify the tax filing process and reduce the chances of errors. By understanding how to use this document correctly, senior citizens can more effectively navigate the relatively complex US taxation system. The Purpose of IRS Form 1040-SR A question frequently asked is the specific purpose of instructions for IRS Form 1040-SR and who it is intended for. This tax form is designated for seniors aged 65 and older who may preferentially use this sample over the standard Form 1040. While not obligatory, the use of Form 1040-SR can be beneficial due to its large, easy-to-read print, and its layout emphasizes income streams relevant to seniors, including Social Security income, retirement plan distributions, and investment income. Using 1040-SR Tax Form: Keys to Consider The form may not be overly complex once you understand the distinct components and the relevant income sources. Here's a summary of key aspects you need to consider: The use of the 1040-SR tax form instructions to accurately report income from various sources that are common among seniors, such as pensions, annuities, and social security benefits, among others. The form features a standard deduction chart which is convenient for taxpayers who opt not to itemize deductions. Following the instructions can help you to determine your standard deduction and taxable income smoothly. Mind the stipulated age criterion. The IRS only permits the utilization of Form 1040-SR for taxpayers who are 65 years or older by the close of the tax year for which they are filing. Common Mistakes in Filling the 1040-SR Form The tax form 1040-SR instructions are meant to guide you through the process, but common mistakes can still occur. These might include errors in: income reporting, misspecifying filing status, incorrect calculations of the standard deduction. To avoid such errors, seek guidance from IRS documentation, hire a professional tax adviser, or use reliable software designed for this purpose. Such resources can inform you of any IRS changes for 2023 and beyond. Remain vigilant while filing, and understand the process becomes less complex with time, preventing future complications and ensuring a smoother tax return process. Do remember to factor in tax updates and amendments, such as those in IRS Form 1040-SR instructions for 2023, as these changes might substantially impact your tax position. Fill Now -

![image]() 1040-SR Tax Return Form While navigating through the ever-evolving landscape of tax preparation, understanding the unique characteristics of various forms is crucial for taxpayers of all ages. For seniors, the federal tax form 1040-SR for 2022 plays a substantial role in this process. Released by the Internal Revenue Service (IRS), the form is designed to simplify tax filing for taxpayers 65 and older. To help you better understand the IRS tax form 1040-SR for 2022, let's dive deep into its distinctive features, advantages, and limitations while covering the specific instances that warrant its manual or electronic submission. Tax Form 1040-SR: Printable vs. Fillable The IRS provides two adaptations of the tax form 1040-SR for seniors in printable as well as fillable versions. Their inherent properties cater to the diverse preferences of taxpayers and pave the way for a customizable experience. Printable 1040-SR Tax Form Loved for its physical accessibility, the printable 1040-SR tax return form offers a sense of familiarity to seniors comfortable with traditional methods of documentation. However, it can foster potential errors if the information is illegible. Additionally, submitting the form by mail may induce lengthy processing times. Fillable 1040-SR Form Unlike the printable form, the fillable variant grants direct access to updating your information online. Faster processing times due to immediate data transfer and automated error detection make it an excellent choice for tech-friendly taxpayers. However, this version could challenge seniors less adept at using digital devices. When to Opt for Digital Submission While determining the optimal time to transition with your 1040-SR tax return form submissions from physical to online can feel daunting, there are several telltale indicators to look for. If you are growing increasingly comfortable using the internet, find delays in mail delivery frustrating, or desire instant confirmation of form submission - the digital filing of the tax form may be your best bet. Recognizing the distinct properties affiliated with the different versions of the 2022 1040-SR tax form while evaluating your circumstances can significantly simplify your tax-filing endeavors by helping you choose the right approach for your requirements. Comparing Printable 1040-SR Form & Fillable Template Version Advantages Explanation Quick Overviews The 1040-SR tax form allows for a quick overview of your tax situation, simplifying the tax preparation process. Easy to Use Its simple structure and easy-to-read large print make it ideal for seniors with vision limitations. Printable Direct Submission Filling up a printed copy reduces the chance of incorrect electronic submissions. Concrete Record Keeping a printed copy of the form allows for a tangible record for future reference or in case of any disputes. Specially Designed This form, specifically designed for seniors, caters to common types of income, like social security benefits, investment income, and retirement distribution. Easy Accessibility A fillable 1040-SR tax form online can be easily accessed anytime, anywhere, without physical visitation. Time-Saving It saves time by providing quick, streamlined processing without filling out information manually on paper. Fillable Paperless It contributes to environmental sustainability by minimizing paper consumption. Auto-Calculation The online form has an auto-calculation feature, helping to prevent calculation errors. Updated Versions The online platform regularly updates forms, ensuring the most recent version is always used. Fill Now

1040-SR Tax Return Form While navigating through the ever-evolving landscape of tax preparation, understanding the unique characteristics of various forms is crucial for taxpayers of all ages. For seniors, the federal tax form 1040-SR for 2022 plays a substantial role in this process. Released by the Internal Revenue Service (IRS), the form is designed to simplify tax filing for taxpayers 65 and older. To help you better understand the IRS tax form 1040-SR for 2022, let's dive deep into its distinctive features, advantages, and limitations while covering the specific instances that warrant its manual or electronic submission. Tax Form 1040-SR: Printable vs. Fillable The IRS provides two adaptations of the tax form 1040-SR for seniors in printable as well as fillable versions. Their inherent properties cater to the diverse preferences of taxpayers and pave the way for a customizable experience. Printable 1040-SR Tax Form Loved for its physical accessibility, the printable 1040-SR tax return form offers a sense of familiarity to seniors comfortable with traditional methods of documentation. However, it can foster potential errors if the information is illegible. Additionally, submitting the form by mail may induce lengthy processing times. Fillable 1040-SR Form Unlike the printable form, the fillable variant grants direct access to updating your information online. Faster processing times due to immediate data transfer and automated error detection make it an excellent choice for tech-friendly taxpayers. However, this version could challenge seniors less adept at using digital devices. When to Opt for Digital Submission While determining the optimal time to transition with your 1040-SR tax return form submissions from physical to online can feel daunting, there are several telltale indicators to look for. If you are growing increasingly comfortable using the internet, find delays in mail delivery frustrating, or desire instant confirmation of form submission - the digital filing of the tax form may be your best bet. Recognizing the distinct properties affiliated with the different versions of the 2022 1040-SR tax form while evaluating your circumstances can significantly simplify your tax-filing endeavors by helping you choose the right approach for your requirements. Comparing Printable 1040-SR Form & Fillable Template Version Advantages Explanation Quick Overviews The 1040-SR tax form allows for a quick overview of your tax situation, simplifying the tax preparation process. Easy to Use Its simple structure and easy-to-read large print make it ideal for seniors with vision limitations. Printable Direct Submission Filling up a printed copy reduces the chance of incorrect electronic submissions. Concrete Record Keeping a printed copy of the form allows for a tangible record for future reference or in case of any disputes. Specially Designed This form, specifically designed for seniors, caters to common types of income, like social security benefits, investment income, and retirement distribution. Easy Accessibility A fillable 1040-SR tax form online can be easily accessed anytime, anywhere, without physical visitation. Time-Saving It saves time by providing quick, streamlined processing without filling out information manually on paper. Fillable Paperless It contributes to environmental sustainability by minimizing paper consumption. Auto-Calculation The online form has an auto-calculation feature, helping to prevent calculation errors. Updated Versions The online platform regularly updates forms, ensuring the most recent version is always used. Fill Now